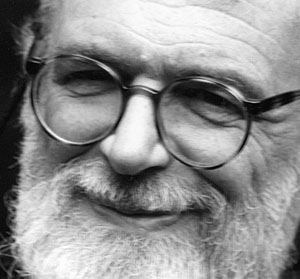

Columbia professor Moshe Adler on why Main Street needs to take economics back from Wall Street.

Moshe Adler fundamentally rejects the notion that what’s good for Wall Street is good for Main Street. In Economics for the Rest of Us, the Columbia University professor of economics argues that the wealthy have hijacked the dismal science and made life for the have-nots even worse. According to Adler, excessive confidence in the efficiency of free markets has led to increasing wage disparities and the mindset that the way things are is how they should be. Or must be.

Economics for the Rest of Us seizes on a resurgence of Depression-style Keynesian economics in its examination of employment, equality, efficiency, wages, and economic efficiency. Adler also raises concerns about the limited utility of Pareto efficiency, an economic concept developed in the nineteenth century by Italian economist and philosopher Vilfredo Pareto. An allocation of goods or resources is deemed “Pareto-efficient” when it is impossible to make someone better off without making another worse off. Pareto efficiency says nothing, however, about equitable distribution.

Economics for the Rest of Us seizes on a resurgence of Depression-style Keynesian economics in its examination of employment, equality, efficiency, wages, and economic efficiency. Adler also raises concerns about the limited utility of Pareto efficiency, an economic concept developed in the nineteenth century by Italian economist and philosopher Vilfredo Pareto. An allocation of goods or resources is deemed “Pareto-efficient” when it is impossible to make someone better off without making another worse off. Pareto efficiency says nothing, however, about equitable distribution.

Adler is the director of Public Interest Economics, an economic consulting firm whose research is used for organizing campaigns, collective bargaining, policy analysis, and eminent domain litigation.

This conversation was recorded live at Columbia’s Studio X in New York City in February.

David Cay Johnston is an author and a Pulitzer Prize winning journalist formerly with The New York Times.

David Cay Johnston: In the introduction to your book Economics for the Rest of Us, about economics and the standard way it is taught, you write:

“Whenever it is necessary to choose sides between the rich and the poor, between the powerful and the powerless, or between workers and corporations, economists are all too often of one mind: according to conventional economic theory, what’s good for the rich and the powerful is good for ‘the economy.’”

Why is economic theory so one-sided?

Moshe Adler: Economics is so one-sided, I think, because it’s the rich who hire economists; it’s just as simple as that.

David Cay Johnston: You talk about a great divide in economics. There is the development of something called classical economics: Adam Smith, Jeremy Bentham, David Ricardo. I am a big fan of Adam Smith; I used him extensively in my last book to illustrate certain points. But that’s not the economics we follow today. Today we follow neo-classical economics. There was a kind of revolution here; can you explain the difference between the two and why we should care?

Moshe Adler: The origin of economics as a science came during the French Revolution, because this was the first time in human history that people had to decide who the government should serve. Louis XIV said, “L’État, c’est moi.” After the French Revolution, people began to ask, “Okay, now we have democracy, a government of the people. Who should the government of the people serve?” It is very simple to say that the government of the people should serve the people. But if you think about it, it is actually impossible to serve the people because there isn’t such a thing as “the people.” After all, some of the people are rich and some of the people are poor, and you cannot serve both at the same time.

Take, for instance, education. Everybody would agree that better education is a good thing to have, but it’s not necessarily very good for the rich because they would have to pay for it.

So who should the government serve? The first French Constitution—which was actually voted on by the people of France rather than being passed by a legislature—declared that the poor are the responsibility of the government.

This Constitution was put on hold and was not implemented, however, and the excuse that was given by the government was that France was under attack by all the monarchies of Europe. In response some citizens organized “the Conspiracy of Equals” which said, “No, maybe we cannot do everything we would’ve done in peacetime, but it is still the responsibility of the government to take care of the poor, and we are not going to put it aside.” Of course, they were guillotined, and the next French Constitution was not ratified by the people and did not have the requirement that the government would take care of the poor.

But in the early nineteenth century Jeremy Bentham, a wealthy Englishman, picked up the challenge. When asked who the government should serve, he responded that we have to be “scientific” about it and think about whether a dollar in the hands of the government would do more good if it is spent on the rich or on the poor. And he asserted that a dollar will produce more utility if it is spent on the poor, and the total utility of society will increase if you take money from the rich and give it to the poor.

This is precisely what some people didn’t like and in particular someone by the name of Vilfredo Pareto, who didn’t like it one bit. Pareto introduced the possibility that when you take a dollar from a billionaire and give it to a family to save its dying baby, you actually decrease the level of utility in society. Who are you to know whether the rich do not suffer more from the loss of a dollar than the dying baby would gain, was the essence of his question.

Based on this objection alone, economists removed Bentham’s idea that economic deficiency requires redistribution. They removed redistribution and any concern with distribution from the definition of economic efficiency.

Ben Bernanke made a career basically trying to make us forget what Keynes had observed and taught us.

David Cay Johnston: This idea of whether you have wealth or don’t have wealth, does this occur in a vacuum, or does the government have some role, a priori, in the distribution of wealth—in the distribution of incomes?

Moshe Adler: This is where Adam Smith comes out most forcefully, because he explained that all production is done by teams. How the product of the team is divided between the people who have produced it together is determined by the bargaining power of each at the bargaining table. He explained that bargaining power is determined by the ability of workers to say no to a low wage on the one hand, and the ability of employers to say no to a high wage on the other. Adam Smith explained that your ability to say no to a low wage depends on how much money you have in the bank and on whether you have to accept the job because you must feed your family and you cannot wait to find a high-paying job. If you cannot say no, you will accept the low-paying job. Employers are more powerful in this regard because they have more money in the bank. But Smith also explained that workers can overcome their infirmity by having unions. And he complained bitterly that the government actually always sides with the employers and against the employees, and always uses its state power to put down unions.

David Cay Johnston: One of the things we teach, and whether your news source is Fox News or the New York Times you will hear the same thing, is that there is an equilibrium. There’s supply and demand, and wages will reach the point where people will supply their labor. So, well, what’s the problem?

Moshe Adler: Well, there are actually two problems with that. First of all, this idea that there is an equilibrium is the idea that, left to its own devices, a market system will always equilibrate. This means we will not have a recession, and we will not have a depression. And this is something that John Maynard Keynes went against during the Great Depression and basically said, “Look, this is the theory, open the window, there’s the reality.” The reality is that the market is not self-equilibrating. We have unemployment, and we have to recognize that the theory just doesn’t work. The Chairman of the Federal Reserve, Ben Bernanke, was a student of Milton Friedman’s and made a career basically trying to make us forget what Keynes had observed and taught us, which is that the market system is not self-equilibrating, and the problem is that giving money to the bank will not solve the problem of unemployment.

The other side of the same issue is the argument that wages reflect the value of what people produce: as long as people get the value of what they produce, there will be an equilibrium, which means, again, that you will not have unemployment. And therefore we run into this fantasy that any time you have unemployment the reason for it must be that wages are too high. So if you have unemployment the cure for it is lower wages; if you were to pass a law that raises wages this would create unemployment.

David Cay Johnston: During the Great Depression, although the official measure was that we had 25 percent unemployment, there are some historians who argue that it was in reality closer to 50 percent. We’ve had people go back—people who have views similar to Milton Friedman, including Robert Lucas, who I believe was a Nobel Prize winner—who have argued that unemployment in the Great Depression was voluntary. Correct?

Moshe Adler: This is precisely true. The argument is that if a worker gets just the value of what she produces she will always get hired; the only reason the worker would not get hired is that she demands a pay rate that is higher than the value of what she produces.

So basically this is the theory behind the argument that we should not raise the minimum wage, or that we should not have unions, or that unions are the aristocracy of labor, because they have higher wages for their workers. This is good for their workers, for the union members, but it must come at the expense of other workers, because the higher wages cause unemployment among them.

But I think that today, or I hope that today, it is clear that the pay of executives is not simply equal to the value of what they produce. You have people losing billions of dollars and taking home hundreds of millions of dollars in pay. I think today the claim that in the marketplace people get the value of what they produce can be challenged, and we can challenge it for both sides. Workers do not get the value of what they produce. They get too little, and executives get too much.

David Cay Johnston: So let me pursue that point for a minute, then. If neo-classical philosophy is correct, executives would not be overpaid and ordinary workers would not be underpaid. But executives—and we have many in this country now who year after year make eight- or, some of them, nine-figure annual incomes—keep getting hired and rehired. Isn’t that proof that the market is really just distributing resources according to these executives’ contribution to the value of the company?

Moshe Adler: Well, the real issue here is that the corporations have nobody to mind the store. The ownership of corporations is extremely diffused and, therefore, there is no single owner of the corporation. I am an owner of I don’t know how many thousands of corporations myself; I don’t even know which ones they are. I own some mutual funds, and these mutual funds probably hold more mutual funds, and those mutual funds hold some mutual funds. I owned General Motors for many years as a stockholder, and now I own it as a voter. It’s very hard to get rid of.

In a corporation there is nobody to mind the store and we have to recognize that. The only way that our interests as workers, as citizens, and as shareholders can be protected is by government laws that would put limits on what executives can pay themselves.

You enter the discipline of economics with common sense, and then it’s beaten out of you. In the end, you buy into this idea that we can have a definition of economic efficiency without caring about what happens to people.

David Cay Johnston: In each of the things we’ve talked about here there seems to be an unstated but continuing theme, beginning with your story about the French Revolution. And that is that these outcomes that we’re seeing in the real world are opposed to the outcomes one changes by moving symbols around on a piece of paper. In theory, the outcomes John Maynard Keynes saw when he opened the window and looked outside don’t seem to be so much determined by a market as by rules which are set by the government.

And, if that’s so, that raises the question of where does the government get these rules?

Moshe Adler: This is an interesting question. I actually try to discuss this with my students all the time. First of all, we agree that it is very hard to think of a policy that is good for everybody or that is bad for everybody. A policy is always good for some people and bad for some other people. There are always winners and losers. And then we do an exercise where you are an expert on taxes, and we do an exercise where we have a poor person, a middle income person, a rich person and we pick up some service that the government may or may not provide, for instance, school lunch.

School lunch is provided for free to the poor, but everybody else has to pay for it. In the exercise we show that if lunch were given free to everybody, then the cost of lunch would go down substantially to middle class people, even though the tax that they would have to pay would get tripled. So the tax gets tripled, but the cost to the middle class is exactly one third what it was before.

I then tell the class to imagine that I am a candidate for office, and that I tell voters that if they vote for me, I will triple their tax. The class agrees that this is not a good promise to make during an election campaign.

David Cay Johnston: Why do we keep hearing things that, as you repeatedly show in your book, do not stand up to scrutiny but are treated as perceived truth?

Moshe Adler: I don’t think I’m an expert on that.

David Cay Johnston: You wrote a book, you’re an expert.

Moshe Adler: Not on that. As to the question of why people after the French Revolution were caught and beheaded, I don’t know. But this struggle is not over. We have major restraints on workers who try to organize unions, workers who try to picket and who try to get higher wages. We have many laws that we should have fixed already, given how many times we had Democratic administrations.

Why we are unable to do that, I am not entirely sure. But one thing is clear to me, and that is that economics should have been the science that would serve the rest of us. You enter the discipline of economics with common sense, and then it’s beaten out of you. In the end, you buy into this idea that we can have a definition of economic efficiency without caring about what happens to people.

President Obama said in his State of the Union Address that since December the recession has been over, and he congratulated his administration for that. He also told us that the way we got through the recession was by giving a trillion dollars to the bankers, and that’s a good thing, and now we don’t have any money for ourselves so we are going to freeze government spending.

So although everyone agrees that the key to the future of our kids is education, we are firing teachers all over the country, and we are raising tuition for state colleges everywhere.

I mean, why do we let the president have Larry Summers as his chief economic adviser?

David Cay Johnston: Let me ask a question about redistribution. The conversation about redistribution is always discussed in terms of taking from the rich, presumably the productive class, and giving to the poor, often characterized, subtly perhaps, as the undeserving or unproductive class.

But is it not possible that what we’re really doing is redistributing upwards? That the government, by its rules, is causing people at the bottom to have less and people at the top to have more, than they would in an economy with a utilitarian approach that Smith and Bentham wrote about?

Moshe Adler: I think you hit the nail on the head, but I think that before we have redistribution we need some justice in the division of what it is that we produce together to begin with.

We need some simple laws: A limit on the ratio between shareholders’ income and executive income on the one hand, and between the highest and lowest paid employee within the corporation, which is now on average about 430, and is increasing over time with no relationship to profits. We can see now that actually you can make tons of money when you are losing money for your corporation.

So what happens is that we have a situation here where executives have it rather easy. When it comes to workers, they say, well, we cannot raise your wage because you are getting paid what you are worth. When it comes to my wage as an executive, to my salary of $10 million or $100 million or whatever it is, well, don’t tell me that it is my fault that my corporation lost money, because we don’t know what it is that each individual person produces. So when it comes to the wages of workers, we cannot pay you any more because you get exactly what you produce. You cannot pay me any less, however, because when it comes to me, how do you know what it is that I have produced? So we are losers here at both ends, and we cannot solve it on our own. This is why we have a government. It is a government of the people. We have to realize that we are the people.

But my concern is really with the field of economics. The field of economics has been taken over by the rich. Every theory that made sense, and was also empirically true, and also sided with workers and the poor was thrown out for absolutely no reason whatsoever and replaced by theories that have no validity to them. Particularly the theory of wages. The theory that says that people get the value of what they produce is so patently wrong.

David Cay Johnston: By the way, I did a calculation a while ago about executive pay over the last forty years of senior executives, by which I mean the five main officers whose pay was disclosed. If the stock market grew at the same rate as their pay, the Dow, which has been hovering for a long time around ten thousand, would be at eighty thousand.

So what do we do to get away from the economic equivalent of geocentrism?

Moshe Adler: I’m not sure that I have a real answer to that, but the fact of the matter is that the Great Depression gave us an opportunity to have Keynesianism, and that was what was leading our economic policy for about twenty to twenty-five years, between 1935 and 1960 or something like that. What happened is that once the memory of the Great Depression kind of faded, the attack on Keynesianism started. It was actually led by Milton Friedman and his number-one water carrier Ben Bernanke. They agreed that Keynes was wrong, and that had we left it to the market everything would have been ok: The Great Depression was the fault of the Federal Reserve. In fact, at Friedman’s ninetieth birthday party Ben Bernanke gave a toast that said “Milton, you were right, we were wrong.” “We” meant the Fed, though Bernanke was not the chairman at the time. What he said was basically, we are not going to let this happen again. And what he did now when it happened on his watch, this recession, this disaster we’re in right now, was that he gave a trillion dollars of our money to the banks.

Now, Keynes would have thought that laughable. Keynes had said that periodically—for reasons that nobody can know, predict, or understand and nobody can fix, in particular not the government—investors lose their confidence, they lose their optimism. This optimism cannot be revived. The government should not try to revive it, but should hire workers itself. And FDR did some of that; he hired three million people to build the national parks, to paint and draw murals on public buildings, and he hired even historians to do oral history, odd jobs that we needed and we still do. He said that the government cannot revive investment artificially because after the Depression or during the Depression or during the recession, people lose confidence and do not know what is a good investment.

We see it right now. What happens is that the banks are not lending out money and very few people ask them for money. And why should they lend out money? It would be imprudent, actually, to lend money now. We don’t know what is a good investment. Investors are also prudent and they are not investing, because they do not know now what is a good investment. So giving this money to the banks would not have made a difference, and in fact, it has not made a difference. It did not produce any jobs, it only took the trillion dollars away that now they claim they don’t have for the rest of us.

David Cay Johnston: I think what you’re saying is that, fundamentally, there is a bias in neo-classical economics. It is biased in favor of the already haves. As a society, all of us, including the rich, would be better off in the long run if we would get away from this inherent bias that’s in neo-classical economics. And think more openly about what’s happening in our society.

To contact Guernica or Moshe Adler, please write here.